Green new world

What new ESG rules will mean for advisers and why now is the time to prepare

The Financial Conduct Authority has set itself ambitious targets to support the financial sector in driving positive change on climate issues, while also building trust in green financial markets and increase transparency around sustainability.

On October 25, the FCA issued its consultation on a package of measures to tackle greenwashing.

It proposed measures including investment product sustainability labels and restrictions on how terms like ‘ESG’, ‘green’ or ‘sustainable’ can be used.

The proposals have been a long time coming for some. In November 2021, the FCA published its ESG strategy alongside a discussion paper on implementing the government’s ambitions for Sustainability Disclosure Requirements and investment labelling.

But while the regulator intends to solve the ESG terminology conundrum by introducing a set of investment labels, something needs to be done to combat greenwashing while we wait for the FCA's rules to come into force.

The regulator intends to publish its final rules by the end of the first half of 2023.

Among its rules, the FCA is proposing:

1) Consumer-facing disclosures to help consumers understand the key sustainability-related features of an investment product – this includes disclosing investments that a consumer may not expect to be held in the product.

2) More detailed disclosures, suitable for institutional investors or retail investors that want to know more.

3) Requirements for distributors of products, such as investment platforms, to ensure that the labels and consumer-facing disclosures are accessible and clear to consumers.

So, are you ready to play your part towards achieving a green new world?

The below report, which is worth 30 minutes of CPD, looks at what changes are coming advisers' way and what they can do now, to ensure they and their clients are prepared.

Actual ESG: growth investing in change

Partner content provided by Baillie Gifford

Poll: How prepared are advisers for ESG?

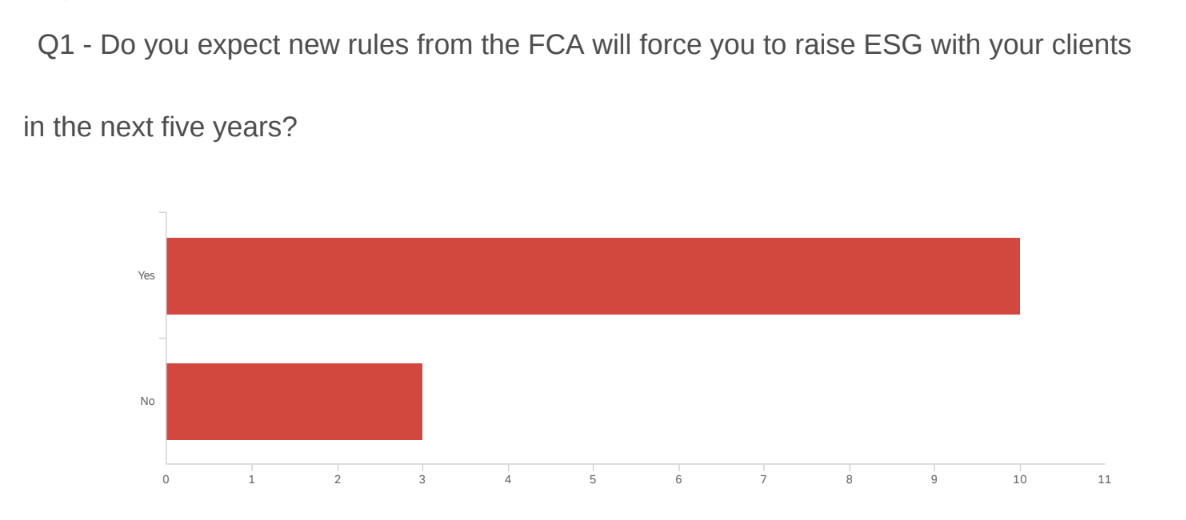

An FTAdviser poll among a target group of advisers, carried out on September 29, has shown the vast majority expect to be forced to raise ESG with their clients within the next five years.

The FCA has given a clear indication that this is its plan, by creating sustainable investment product labels that will give consumers the confidence to choose the right products for them.

It is also focusing on how products are marketed and what sort of disclosures are made, whether by product providers, platforms and all distributors of products.

Mike Head, director at advice firm Ethical Investors, says: "I hope genuinely that the next thing up [after investment labels] will be an expectation from the regulator that the ESG question is being asked properly and documented...it should be already as part of Prod and everything else."

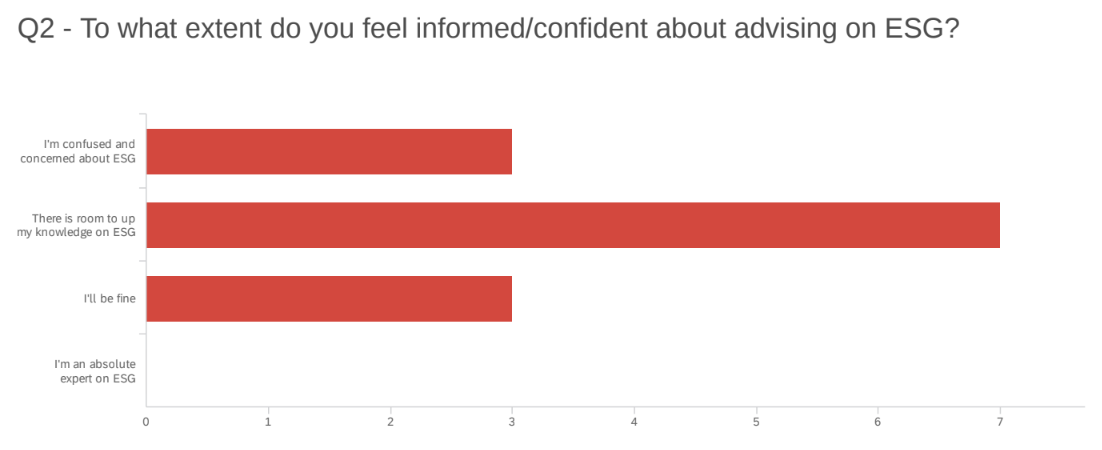

Asked to what extent the advisers felt informed and confident about advising on ESG, the majority acknowledged there was room for improvement and nobody claimed to be an expert.

An equal number, 23 per cent of our small adviser group, were very concerned or confident they would be fine.

Confusion about ESG among investors and advisers has been well documented, with concerns about greenwashing being a particular sticking point.

Experts believe greenwashing is less of a problem of dishonesty and has more to do with a general confusion about the strategy the client is looking to pursue and that which the fund is deploying.

Things start to go wrong when people look into funds and find things they don’t expect, says Holly Mackay, founder of Boring Money, whose own research found an “awful lot of confusion and continued growing scepticism about greenwashing from advisers and investors”.

Engagement and transition is becoming more popular but investors need to know what’s going on, she says. “It just needs a couple of lines of positioning. It’s a question of rethinking what info do investors really need, what do they want to know...and make sure to talk to those points.”

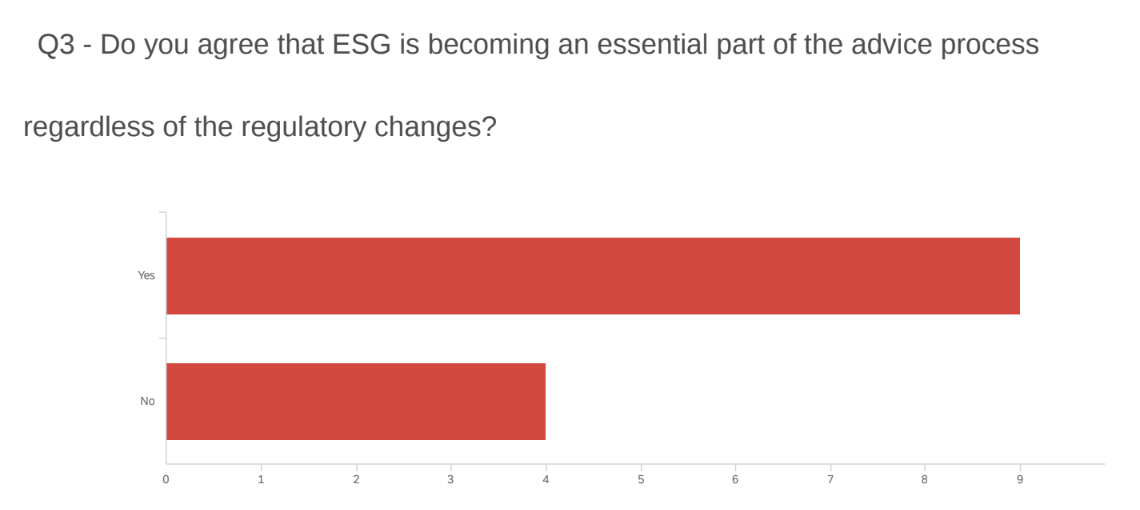

With our final question we asked advisers whether they thought ESG was becoming more important regardless of regulation. Two-thirds believed ESG was becoming an essential part of the advice process, which makes it even more important for advisers to be given the tools to advise on the assets properly and with confidence.

The below CPD is designed to provide a starting point for advisers to be able to summarise how ESG rules might change, get an understanding of how to approach ESG with clients, and learn about some of the challenges posed by ESG portfolios.

Source: FTAdviser

Source: FTAdviser

Source: FTAdviser

Source: FTAdviser

Source: FTAdviser

Source: FTAdviser

CPD: What new ESG rules will mean for advisers and, why now is the time to prepare

Last November, as debates among world leaders raged on at the United Nations Climate Change Conference (COP26) in Glasgow, the financial regulator published its ESG strategy alongside a discussion paper on implementing the government’s ambitions for Sustainability Disclosure Requirements and investment labelling.

Further policy proposals were meant to be published for consultation in Q2 this year, but instead came out on October 25.

So what rules are coming advisers’ way?

The FCA is proposing to introduce:

- Sustainable investment product labels that will give consumers the confidence to choose the right products for them. There will be three categories – including one for products improving their sustainability over time – underpinned by objective criteria.

- Restrictions on how certain sustainability-related terms – such as ‘ESG’, ‘green’ or ‘sustainable’ – can be used in product names and marketing for products which don’t qualify for the sustainable investment labels.

- A more general anti-greenwashing rule covering all regulated firms. This will help avoid misleading marketing of products.

- Consumer-facing disclosures to help consumers understand the key sustainability-related features of an investment product – this includes disclosing investments that a consumer may not expect to be held in the product.

- More detailed disclosures, suitable for institutional or retail investors that want to know more.

- Requirements for distributors of products, such as investment platforms, to ensure that the labels and consumer-facing disclosures are accessible and clear to consumers.

- The FCA is also stepping up its supervisory engagement on sustainable finance and enhancing its enforcement strategy.

According to Sacha Sadan, the FCA’s director of environment, social and governance, "greenwashing misleads consumers and erodes trust in all ESG products. Consumers must be confident when products claim to be sustainable that they actually are. Our proposed rules will help consumers and firms build trust in this sector."

The FCA’s proposals are interesting, says Hortense Bioy, global director of sustainability research at Morningstar UK, “because, unlike the EU regulator, the FCA has decided to take a labelling approach.

“Investors like labels because they’re easy to consume. To make things even easier, the FCA has also shared how products already classified under SFDR can map against the UK framework.”

Terminology for the labels is still under consultation until the end of the consultation period in January 2023, but the regulator could be looking at ‘sustainability focused’ (what was previously ‘aligned’); improvers (what was previously ‘transitioning); and impact, she suggests.

Meanwhile the FCA is also implementing the consumer duty, which will force advisers to deliver good customer outcomes and foster client understanding of what they are buying. Some believe this could effectively force an adviser’s hand when it comes to sustainable investing as they will need to seek to understand their clients’ preferences fully, including ESG.

In time there will be “an expectation from the regulator that the ESG question is being asked properly and documented,” says Mike Head, director at advice firm Ethical Investors, but he adds advisers should understand that these conversations will not be detrimental to the adviser-client relationship.

Climate action at COP26 in Glasgow (William Gibson)

Climate action at COP26 in Glasgow (William Gibson)

(Credit: Photo by Jan van der Wolf)

(Credit: Photo by Jan van der Wolf)

(Credit: FCA)

(Credit: FCA)

Credit: Cottonbro/Pexels

Credit: Cottonbro/Pexels

Credit: Charles Deluvio

Credit: Charles Deluvio

Credit: Scott Graham

Credit: Scott Graham

Talking ESG with clients

Head recommends starting the process with new clients, who are less likely to query why the subject has not been raised before.

“I wouldn't recommend asking 'how do you feel about ESG’ or something similarly jargon heavy,” he says.

“An easier way to start the conversation would be: 'have you ever wondered where your money is invested’ or ‘do your mind where your money is invested’.

“Having and recording this conversation covers the compliance issue - by asking, you avoid the risk of comeback if they have the sustainable investment conversation elsewhere.”

When it comes to existing clients, he says advisers should address the subject at review stage. “They should start by saying this is something that we're now looking at, it's a new initiative, it’s something that we've been monitoring.

“There are lots of ways that you can make it possible to have the conversation without it looking like you didn't really care to find out.”

Not having the conversation, he says, could be detrimental. “To suddenly discover that someone you've been dealing with hasn't bothered to find out that you're actually seriously bothered about the environment… is going to be quite a tricky conversation.”

But he said advisers should never try and pretend to be experts because they might come up against people who have spent their lives reading about the subject and might know more than the adviser. “But preparing yourself by starting to look at what you've got and who they are [is a good start].”

Mark Armstrong, founder of advice firm Blue Sphere, says advisers need to ensure offering ESG does not become a tick box exercise should the FCA follow through with its intentions to make raising the subject mandatory.

“When I've spoken to advisers in the past, we've got advisers who just see this as basically a tick box exercise. ‘Does the client have any ethical values? Yes, they do. Okay, great. We can put you into this ethical fund.’

“I don't think that's going to be good enough moving forward. …It’s our job to make sure that we're bringing sustainable and impact investing to our clients, to explain to them what it is and not wait for them to ask.”

This is not least to ensure advisers understand what type of ESG strategy clients are interested in.

There are a myriad of different strategies, from purely exclusionary - screening out negative stocks - to ESG integration and transition strategies, and impact.

Research from Boring Money, carried out this year, shows impact investing has become a priority for many investors in the UK, as 14 per cent of ESG investors are now so committed to sustainable investing they put ESG criteria first and performance second when selecting investments.

Myriad strategies have also contributed to accusations of greenwashing, which experts agree, is often more a problem of misunderstanding than actual lying.

As ESG veteran Julia Dreblow, director of SRI Services, recently told FTAdviser: "Some greenwash allegations result from differences in opinion, and sometimes greenwash is simply over-exuberant marketing borne of inexperience.

"There are funds that have shocked me, where it seems unlikely that over-exaggeration was accidental… but such examples are in the minority."

Paris Jordan, multi asset analyst at Waverton Investment Management, agrees the majority of greenwashing tends to be related to “poor communication of an investment approach, rather than actively trying to pull the wool over investors’ eyes.”

But different strategies can also aid diversification of portfolios, says Jordan.

Building ESG portfolios

Diversification in ESG can be tricky given that the stocks are growth stocks by nature. This has been felt somewhat in the past year, which saw rotation to value stocks accelerate.

Research by Bowmore found in July that the higher a fund’s ESG rating the worse its returns were over the year to June 22.

The bad performance was largely down to the underperformance of certain sectors seen as more ESG-friendly, while sectors such as commodities, oil and gas, mining and defence saw bumper returns this year.

In response, data from Morningstar shows, flows into UK sustainable funds deteriorated from February, and August saw the first month of net outflows since March 2020, with £199m being pulled from the funds.

Head suggests some growth stocks might have been overvalued but he says “things will get better”, before quipping: “If people genuinely imagine that the long term future is investing into oil, gas and tobacco, it seems like they might be on the wrong side of that trend.”

In order to construct portfolios, many ESG advisers use model portfolio services. These can make their lives easier in terms of stock picking, research and ensuring the investments align with the desired outcomes, which can also change over time.

“If you are new to the subject, the opportunities to confuse both yourself and your clients are myriad,” says Head. “If I were dipping a toe into this market I would find a sustainable MPS provider and use that as my go-to offering.”

But he says advisers must ensure their DFM’s processes are robust. For instance, they should not rely on ratings agencies but use scoring merely as a starting point.

At the end of the day all of that goes out the window when you're looking over the long term

Jordan, who works at DFM Waverton, says it is much easier to diversify ESG exposure these days as there are now plenty of opportunities across all areas of the style spectrum. But this might mean moving away from purely negative screening to strategies such as helping firms become greener.

The proliferation of engagement, transition and sustainable value funds has exploded in the short term and we expect this to continue,” she says.

“Equally, this has brought the discussion away from purer, solution-only ESG stocks, and brought more focus to transitioning companies as we try and meet net zero goals – for example, in order to meet a number of our goals, we are going to need a huge amount of commodities.

“Consequently, greener commodity funds or climate change focussed opportunities are now available.”

Armstrong agrees choice has proliferated as the market matured especially on the bonds side, which has made it easier to build portfolios.

"Initially, we might have had to have a heavier weighting in cash because there might not have been as good bond structures as there are now but there's more and more bonds coming online as the market matures so it's getting easier and easier," he says.

Paul Grainger, head of global fixed income & currency at Schroders, agrees fixed income can play an important part in diversifying an ESG portfolio.

Schroders runs a sustainable sovereign debt fund to help DFMs diversify their ESG portfolios, which is predominantly invested in high quality debt.

"As inflation peaks and the markets turn their attention to growth slowdown/recession core fixed income should perform well and already have attractive yield and income characteristics,” he says.

"Within that holding green bonds, especially green sovereign bonds, can allow investors to have diversification whilst still meeting the sustainable or ESG criteria.”

But Armstrong also points out that most portfolios are built for the longer term. “We invest for at least five, normally 10 to 15 years of which by that point we know the market ebbs and flows through growth phases, through value phases.

“It slows, it speeds. At the end of the day all of that goes out the window when you're looking over the long term. And that's how we view it.”

Credit: Tima Miroshnichenko

Credit: Tima Miroshnichenko

(Credit: AP Photo/Michael Probst)

(Credit: AP Photo/Michael Probst)

(Credit: REUTERS/Angus Mordant)

(Credit: REUTERS/Angus Mordant)

Time to act

The FCA’s new ESG rules have only just started the consultation process, but the direction of travel seems clear.

The regulator, tasked with considering climate change by the government, wants to contribute to a net zero world and will try its best to whip the market into shape to allow it to do that.

Advisers would be well advised to act sooner rather than later to have the processes and knowledge in place to facilitate ESG conversations, says Dreblow, who is a member of the FCA’s Disclosure and Labels Advisory Group.

“[The FCA’s] approach which we understand to be high level client friendly labels, coupled with better information flows, should enable growth and diversity without shackling our industry. It will also give advisers a better launch pad from which to discuss fund options with clients – and should make their lives much easier once things settle down,” she says.

She adds she does not expect specific rules for intermediaries just yet. “However it is important to remember that advisers have been required to know their clients and offer appropriate products for many years.

“As such, advisers who do not explore or meet clients’ sustainability and climate change preferences are, in my view, currently putting themselves at risk.”

Head agrees: “[Advisers] need to get ready now. It's going to be quite a tricky conversation.” Besides, he says, advisers shouldn’t look like they are being forced to raise the subject by new regulations, they should come across like they genuinely care.